by Rob Schrum, myWireless.org

WIPP is a proud partner with AT&T for their “It Can Wait” campaign

September is here, and we’re shifting the It Can Wait® movement into high gear! During this month, we want you to show your commitment to this cause by sharing our new impactful video, “Close to Home.” There’s power in numbers!

Friends, family members, and even your social network can make a difference. While many of us have hundreds of smartphone contacts, new research from AT&T found that 2-in-3 people have almost all or most of their smartphone communications with just 5 people. More than 8-in-10 surveyed said they’d likely stop or reduce their smartphone use while driving if one or more of their top 5 contacts asked them to.1 Let’s band together and keep each other safe behind the wheel. Here’s how:

Spread the Word

During the month of September, you can spread the word by:

- Sharing this video “Close to Home” on social with your family, friends, and social network. Your influence can help keep those closest to you safe. #Tag5toSave5 friends by encouraging them to share this life-saving message.

SAMPLE POST: No post, glance, or email is worth a life. RT to pledge to keep your eyes on the road, not on your phone. #ItCanWait http://soc.att.com/1PJXypp

- Renewing your pledge. Go to ItCanWait.com to extend your commitment beyond not texting while driving. No text, search, post, glance, or email is worth a life.

Thank you for your loyal commitment to helping us take the distraction out of driving. Please use this email to communicate the importance of safe driving and remind your network that no emailis that important. It Can Wait.

Follow us on Twitter @ItCanWait

Visit us at ItCanWait.com

Visit our merchandise store

How PPACA Will Affect Your Business The Next 5 Years?

By Todd Covert, Executive Vice President of ACA Track

By Todd Covert, Executive Vice President of ACA Track

The Patient Protection and Affordable Care Act (PPACA) – also known as the Affordable Care Act or ACA – is the landmark health reform legislation passed by the 111th Congress and signed into law by President Barack Obama in March 2010. The legislation includes a long list of health-related provisions that began taking effect in 2010 and will “continue to be rolled out over the next four years.” Key provisions are intended to extend coverage to millions of uninsured Americans, to implement measures that will lower health care costs and improve system efficiency, and to eliminate industry practices that include rescission and denial of coverage due to pre-existing.

What does it mean for business today?

Business With 50-99 Employees 2015

Key Point #1

Navigating through transition relief to determine the date you need to make sure you are in compliance.

Applicable large employers (ALEs) with fewer than 100 full-time employees, including full-time equivalent employees, may have until 2016 to offer health insurance to eligible employees and their dependents without facing penalties.

This transition relief is available to employers who can certify that they have not reduced their workforce to remain under the threshold and have not materially reduced or eliminated health coverage previously offered. This certification needs to be included with your filing under Section 6056 for 2015.

The IRS will still grant transition relief to employers who reduced their workforce for “bona fide” business reasons.

Key Point #2

If you are over 50 FTE (Full-Time Equivalents) or part of a control group (Parent Company) with more than 50 FTE than you MUST file the 1095-C and 1094-C even if you do not offer coverage.

Key Point #3

Don’t “expect” your payroll company to complete these 1094-C and 1095-C forms.

Why? Most payroll companies don’t even track the information required to complete these new IRS forms—It is more a benefit enrollment and plan design function than payroll.

- Dates of hire and waiting periods determine when employees are in the limited assessment period. Partial months are treated uniquely differently than full months and the series coded will change. Most payroll vendors only track deductions.

- Termination, rehire dates and class changes impact offer of coverage and safe harbor designations. Employees with a number of changes during the year can see a variety of different codes appearing on form 1095. Not a payroll function

- Offer of coverage determines whether 70% (2015) and 95% (2016) levels are reached or significant penalties are to be paid. Not a payroll function

- Safe harbor designations and income drive affordability calculations. Not a payroll function

- Transition relief provides the ability to mitigate risk and avoid penalties altogether. Not a payroll function

Key Point #4

Start balancing culture and cost now because the “Cadillac Tax” is on the horizon in 2018—It’s not a matter of “IF” we hit the Cadillac Tax it’s a matter of “When” we hit the Cadillac Tax.

If health insurance exceeds $10,200 in premiums for an individual or $27,500 for a family. The tax amounts to 40 percent of the cost above that threshold AND its Non-Tax Deductible.

Why do we say “When” we hit the Cadillac Tax? The insurance cost threshold ($10,200 in premiums for an individual or $27,500 for a family) only increases at CPI each year which is about 3.1% and Healthcare inflation increases close to 8.0% thus the X & Y axis lines are eventually going to cross.

Please join us September 29th for Women Accessing Capital: 5 Things You Need to Know About the New 1094-C and 1095-C IRS Reporting. Register now!

ChallengeHER 2015 Update … Fall Edition

A substantial part of Women Impacting Public Policy’s (WIPP) Federal Procurement Programming lies undoubtedly with ChallengeHER. ChallengeHER is an educational program, which provides women business owners with the guidance to better compete for federal contracts under the Women-Owned Small Business (WOSB) Federal Contract Program.

In order to provide as much impact as possible and to get women business owners together with federal buyers, ChallengeHER events are being held in several cities and states throughout 2015. As the year is progressing toward the fall season, several events have already been held (e.g. Washington D.C., New York, Dallas, Atlanta, New Hampshire), but many more are still scheduled until the end of the year. And what can participants expect?

ChallengeHER provides women around the United States with the most important, standardized knowledge and guidance in the federal marketplace and an opportunity to:

- Learn about the WOSB set aside program and how to market their business using this set aside.

- Learn from experiences and best practices of successful WOSBs working as federal contractors.

- Find out from federal buyers how to do business with their agency in Federal Buyer’s Panel.

- Participate in one-on-one matchmaking sessions with federal buyers at most events.

- Learn about the new Sole Source Authority rule! More information on SBA’s announcement integrating a sole source component into the WOSB procurement program starting October 14, 2015, can be found here.

- Network with peer mentors and other WOSB and Economically Disadvantaged Women-Owned Small Business (EDWOSB) firms.

Some of the participants’ feedback:

“I am glad I was able to attend ChallengeHER. The speakers were great and very informative.” – Attendee from New Hampshire event

“I am glad I was able to attend ChallengeHER. The speakers were great and very informative.” – Attendee from New Hampshire event

“ChallengeHER provided me with pathway to applying for federal contracts and becoming a successful women business owner.” – Attendee from Atlanta event

“I truly appreciate the information shared. It provoked me to think differently about how I was running m y business. I was so inspired I even recorded the speech.” – Attendee from Atlanta event

y business. I was so inspired I even recorded the speech.” – Attendee from Atlanta event

“As well as strong individual speakers, it was particularly helpful to have “panels” that provided different perspectives at once.” – Attendee from NYC event

Registration for upcoming events is available for:

- Santa Ana, October 8

- Cincinnati, October 16

- Denver, October 21

- Washington D.C., November 6 (Department of Energy)

More events to come will be held in Central New Jersey, Baltimore, Kansas City, and Orlando in Florida throughout November and early December 2015.

ChallengeHER aims not only to provide one time learning experience but also to build a standing long-term knowledge and support base for its participants. Therefore additional resources are available for attendees both before and after the event:

- To prepare and get ready for discussions and topics covered during the event by listening the following courses:

- To follow up on gained knowledge and sort out where to go from there, by following 10 Quick Steps for guidance to successful federal contracting.

For those of you, who are not familiar with the program, here is some basic information:

ChallengeHER, an initiative from the U. S. Small Business Administration (SBA), WIPP, and American Express OPEN (OPEN), is designed to strengthen and promote the Women-Owned Small Business (WOSB) Federal Contract Program. ChallengeHER offers women business owners important information to established and new businesses on working with the federal government. Further, these events enable more women business owners to take advantage of contracting opportunities so they can boost their businesses and help propel the success of the WOSB Procurement Program.

For more information on upcoming events and news visit our website and connect with us online on Twitter, Facebook or LinkedIn.

From The Hill: Dodd-Frank’s Impact on Small Business Lending

By Jake Clabaugh, WIPP Government Relations

Women entrepreneurs face unintended consequences of wall-street reform. According to a House Committee hearing yesterday, the Dodd-Frank Wall Street Reform and Consumer Protection Act, introduced in an effort to prevent another financial crisis, is contributing to small businesses’ inability to access capital from banks.

WIPP’s Access to Capital Platform has cited some of Dodd-Frank’s regulations as a contributing factor to the decrease in small businesses lending. Capital access is a lifeline for small businesses. It is essential for entrepreneurs to have access to sufficient capital to found and grow businesses.

The House Committee on Small Business convened lenders and experts to discuss how Dodd-Frank has affected the ability to provide entrepreneurs with critical capital. Access to private capital, including bank loans is a primary concern to women entrepreneurs as women-owned small businesses receive only 4% of private sector lending dollars. Additional regulatory burdens could be exacerbating this problem.

The House Committee on Small Business convened lenders and experts to discuss how Dodd-Frank has affected the ability to provide entrepreneurs with critical capital. Access to private capital, including bank loans is a primary concern to women entrepreneurs as women-owned small businesses receive only 4% of private sector lending dollars. Additional regulatory burdens could be exacerbating this problem.

The hearing touched on many of the difficulties WIPP members have experienced when trying to access to capital. The Committee cited increased administrative burdens as a significant cost for small and community banks, a primary lender to small businesses. These regulations have increased the cost of making loans and therefore made it more difficult for banks and borrowers. The result is less capital for entrepreneurs.

The hearing also cited the direct impacts on borrowers. Many that would have qualified pre-recession are no longer able to obtain loans from banks due to tighter lending standards. WIPP’s platform advocates for modernized credit scoring that would level the playing field for women business owners.

Until Dodd-Frank is fully implemented, its complete impact will remain unclear. WIPP continues to review ongoing regulations as well as work with Congress to scale back unnecessary barriers to capital access for women entrepreneurs.

Success: Sole Source Finalized

by Ann Sullivan, WIPP Government Relations

When you’ve been working on a program for 15 years, it’s almost anti-climatic when you realize you won and it’s over. I suppose lawyers feel this way when they win a big case, or business owners when they close a major contract.

For me, the SBA announcement integrating a sole source component into the WOSB procurement program on October 14, 2015 marks the end of a long campaign by Women Impacting Public Policy (WIPP). First, we fought for eleven years to establish a program that gives a government buying preference to women-owned companies whose industries have been underrepresented. Not an easy fight – we had plenty of Congressional and White House opponents—it wasn’t until the Obama Administration came into power that the program was established. At the time, SBA Administrator Karen Mills made it her number one priority, which we will always be thankful for. We had strong Congressional proponents – Senators Cantwell and Shaheen and Representatives Speier and Graves.

Then, we had to make the program work. That required two major changes to the program in 2013 and 2014. The first change required lifting the award caps the law imposed on the program. The WOSB procurement program limited contract awards through the program to $4 million ($6.5 million for manufacturing). In 2013, Congress helped us get rid of those caps. The last big piece was the sole source piece—allowing contracting officers to award sole source contracts to women-owned companies through the program. This major change gives the program parity with other small business programs and again, required Congressional action. Effective October 14, agencies will be able to use this mechanism to award contracts to women whose companies offer innovative products and services.

As with all government programs, the rules are a little complicated and the ability to self-certify as a woman owned business will eventually have to change, due to Congressional direction in 2014. But for now, self-certification remains the law and women should be actively pursuing contracts through the WOSB procurement program whether or not they are self-certified or certified by a third party.

It is important to note that not all industries (NAICS codes) qualify for the program. You can find a list at http://www.SBA.gov/WOSB. We have developed a one pager that go through the rules of the sole source portion of the program and our GiveMe5 program has comprehensive information on the WOSB program. In addition, our ChallengeHER events are all over the country so that women can find out more about the program. The information can all be found at www.wipp.org.

The WOSB procurement program is in good hands. All the major pieces to make it successful are in place. When we started this effort in 2002, women received 2.7% of government contracts. Since the program has been in place, more than $500 million has been set-aside for women- owned companies. In fact, in 2014 the government awarded 4.7% of its contracts to WOSBs –a 75% increase since 2002. Now women business owners need to know how to use it with the help of SBA, the federal contracting community and organizations, such as WIPP.

Fifteen years seems like a long time, but when you are fighting for something—somehow it doesn’t seem that long. WIPP members and coalition partners were with us every step of the way. For this, I am exceedingly grateful.

Patents, Trademarks, Copyrights … Protect Your Intellectual Property

A spark of an idea is often the start for building a business. Next steps that come to mind to most people are preparing a business plan, sales and distribution model, marketing strategy, plan for building customer base, etc. However one area that is not always as straightforward is protection of the business idea, business name, or an invention from competitors. Or actually protection of everything that is encompassed by one powerful term – Intellectual Property (IP).

We all know the term but what exactly does it incorporates? According to the World Intellectual Property Organization, “IP refers to creations of the mind, such as inventions, literary and artistic works, symbols, names, images, and designs used in commerce.” Globally IP is divided into 2 main groups – Industrial Property (patents, trademarks, industrial designs, and geographical indications) and Copyright that covers literary and artistic works such as novels, films, music, architectural designs and web pages.

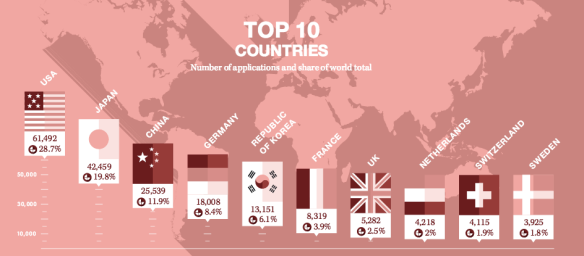

USA accounts for the largest share of filed patents and trademarks applications worldwide with 28,7% and 13,8% respectively as reported by the World Intellectual Property Organization.

However due to complexity of IP processes small businesses account for only small proportion of the numbers. They are usually not properly protected and thus are more vulnerable to piracy, counterfeiting, and the theft of their intellectual property. Small business owners often simply don’t have access to the IP protection know-how that larger corporations do.

However due to complexity of IP processes small businesses account for only small proportion of the numbers. They are usually not properly protected and thus are more vulnerable to piracy, counterfeiting, and the theft of their intellectual property. Small business owners often simply don’t have access to the IP protection know-how that larger corporations do.

And according to statistics of Small Business Administration this is even truer for small businesses, which are exporting their products overseas. Only 15 percent of exporters realize that a U.S. patent only provides protection in the U.S.

Below are the basics to be followed for protecting IP overseas:

- Overseas Patents – Almost every country has its own patent law with specific patent application process, which needs to be followed. More information about filing for an overseas patent can be found here .

- International Trademarks – in certain countries (defined by the Madrid Protocol) trademark registration can be filed via a single application, if you are already a qualified owner of a trademark application pending before the U.S. Patent Office. If you want to protect your trademark overseas you’ll need to file for international trademark protection. More information is available here

And why is it so important to protect ones business intangibles?

Intellectual Property protection is a critical part of small business success and its current or future growth. According to the U.S. Patent and Trademark Office’s stopfakes.gov web site, companies that protect their intellectual property drive more economic growth in the U.S. than any other single sector. In general, IP rights reward creativity, that fuels progress, innovation, spurs economical growth and creates jobs in return.

There are many different resources, to help you gather information on where and how to protect your intellectual property, sba.gov or export.gov are a good start.

We have also a unique opportunity for you to learn more about it during our free webinar on September 21st, which will be led by expert in the IP field, Partner at Holland & Knight law firm, Thomas W. Brooke. Registration is free and open.

Introducing Peer-To-Peer Lending: Alternative Funding for Your Small Business

The Office of Advocacy is an independent office within the Small Business Administration that is a great source for small business statistics, as well as a voice for small business owners that can express their views and issues to policy makers in DC. Today, the Office of Advocacy released an issue brief on “Peer-To-Peer Lending: A Financing Alternative for Small Businesses”.

To explain a little more, Peer-To-Peer Lending or P2P is a funding model where individual investors give small personal loans online to individuals. The Office of Advocacy describes P2P as a hybrid of crowdfunding and marketplace lending.

The issue brief released today details the funding model and gives a side-by-side view of P2P and traditional small business financing options. It also shows how it could affect small businesses in the future, giving them more opportunity for financial growth.

Read the brief to learn more.

Overtime Rule is Over The Top

By John Stanford, WIPP Government Relations

The Department of Labor, it would appear, is working overtime. Two weeks ago, WIPP responded to the agency’s proposal to require labor history for federal contractors. Now, WIPP is addressing a different proposed regulation – this one making changes to overtime pay. Both proposals were well intentioned, and both pose risks to women entrepreneurs.

Disclaimer: this blog is a brief summary, so if your business may be affected I encourage you to read WIPP’s comment in its entirety.

It all began last spring, when President Obama directed the Labor Department to update overtime regulations, saying the standards for some employees had “not kept up with the modern economy.” Specifically, the so-called white-collar exemption was out of date. The exemption allows employers to avoid paying overtime (required anytime an employee works more than 40 hours a week) for executive, administrative, and professional employees because they typically have better pay, benefits, and privileges.

The exemption has three criteria. First, the employee must be salaried. Second, the salary must be above a certain threshold. Third, the employee duties must meet certain criteria – basically, you cannot just give someone a manager’s title and exempt them; they must be acting as a manager.

To answer the President’s call for modernization, the Labor Department proposed to update the second piece, the salary threshold, from roughly $24,000 to $50,440 and index it to economic growth. Essentially, this qualifies white-collar employees who make less than $50,000 a year for overtime pay if they work more than forty hours a week.

WIPP agrees with the President that our regulations do not match a 21st century economy, and we should work on updating these requirements for a fair and modern workplace. Moreover, companies that are purposefully skirting the rules on overtime pay and cheating otherwise qualified employees should be held accountable.

Nonetheless, simply doubling the salary threshold goes too far and achieves too little. While large companies in large cities may be able to afford a $50,000 salary floor, the entrepreneurial community is left with bad options: possibly cut employees to afford a minimum salary for others, or restrict working hours and set up an hourly tracking system. Notably, the Labor Department estimated only a quarter of employees will likely see higher paychecks. Others may see reduced hours.

In the comment, WIPP highlighted concerns about the cost to implement the rule, difficulties in application of the rule, and the dangerous impact on employee wages and benefits.

The Labor Department predicted that simply implementing this change would cost small businesses, including the vast majority of the nearly ten million women-owned firms, between $130-$180 million in the first year alone. That does not include the more than $500 million in increased wages small businesses are expected to pay. The Labor Department itself mentions that business could cut hours and benefits to make up for this loss.

Moreover, to ensure compliance with these new regulations, businesses will begin closely monitoring and tracking their employees’ work hours. Tracking and monitoring employee hours is very difficult, if not impossible, given the evolving dynamics of the workforce. Many white collar employees have flexible schedules, work from home, check and answer emails from smartphones or tablets and are no longer restricted by a rigid 9-5 schedule.

It also isn’t just companies. Non-profits face the same requirements. An exception for them (as well as small businesses) is so narrowly crafted it may not cover many mission-oriented organizations or the smallest of businesses. Both are places where working above and beyond forty hours a week may be more about commitment to a cause than a bigger paycheck. For this reason, WIPP asked that the exception be broadened to actually apply to small businesses and non-profits.

The idea that our regulations need to be updated is not political – it’s common sense. But often the regulatory pendulum swings too far as it has here. As proposed, women entrepreneurs could face the arduous tasks of transitioning current employees from salaried to hourly workers and possibly cutting benefits to make payroll all while tracking and limiting employee hours. Talk about working overtime.

Millennials in the Workplace – What Are Your Thoughts?

Millennials are the largest workforce group since they surpassed Generation X this year and the U.S. Bureau of Labor Statistics pre dicts they will make up 75% of employees by 2030. Therefore it is no surprise that many reports and articles have been dedicated to the topic of how to get along with and manage this generation at work.

dicts they will make up 75% of employees by 2030. Therefore it is no surprise that many reports and articles have been dedicated to the topic of how to get along with and manage this generation at work.

From hiring practices to benefit packages and work-life balance, expectations of this generation are widely different to the ones of Baby Boomers or Generation X.

Towan Isom is a President and CEO of Isom Global Strategies where millennials make up more than 50% of all employees in her company. Since she started the company 15 years ago in her basement, she has accumulated extensive experience and knowledge working with different generations of workers. She shares her insights and often speaks on how to be successful with this intergenerational workforce and on managing millennial employees.

In the end of September, Towan will speak at a conference on Millennials in the workplace, and she offers a unique opportunity to make your insights to be heard. By responding to the quick survey your professional opinion on working with millennials will be shared with her audience and presented in a case study afterwards. The conference will be also recorded and available on Isom Global Strategies website few weeks after the event.

Towan will also share outcomes and her professional views with us here in a guest blog after the conference.